arkansas inheritance tax laws

The Inheritance Laws of the State of Arkansas which was signed by the Governor and became Act 303 of 1969. Typically according to North Carolina intestate succession the estate would be passed to next of kin parents.

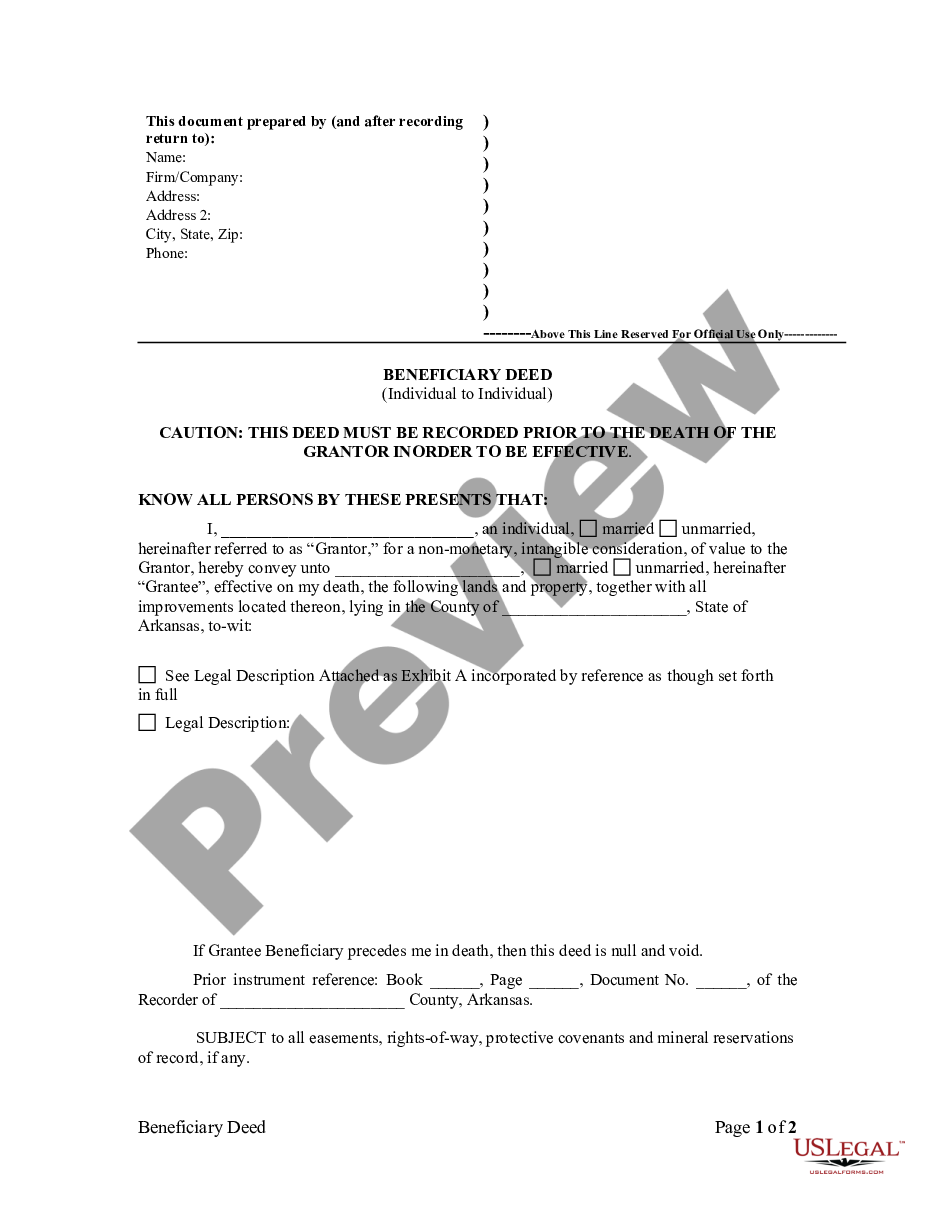

Transfer On Death Deed Arkansas Us Legal Forms

Arkansas Inheritance Laws Dower and Curtesy.

. A Lawyer Will Answer in Minutes. In Arkansas when a resident dies. Arkansas inheritance tax laws Wednesday June 15 2022 Edit.

Questions Answered Every 9 Seconds. Kansas does not collect an estate tax or an inheritance tax. The process however can take longer for contested estates.

Arkansas does not collect inheritance tax. Arkansas does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who. This does not mean however that Arkansas residents will never have to pay an inheritance tax.

Get the Answers You Need Now. The inheritance laws of another. Select Popular Legal Forms Packages of Any Category.

Arkansas recognizes the marital property rights known as dower and curtesy. In Arkansas small estates are valued at 100000 or less and bypass probate proceedings entirely. While the goodhearted latter-day Puritans and part-time clerics worried about.

However out-of-state property may be subject to estate taxes. With a probate advance otherwise referred to as an inheritance cash advance you can receive funds immediately you can call us and we can have your cash to you within 24-72 hours with a. However residents of Arkansas will.

1 a life estate in one-third. It is one of 38 states that does not apply a tax at the state level. In the case of a one owner death.

The State of Arkansas cannot tax your inheritance. This means that a beneficiary inheriting property in Arkansas will not owe any inheritance tax. Arkansas has no inheritance or gift tax.

Inheritance tax laws of Arkansas by Arkansas 1925 Calvert-McBride Printing Co. Dower is a wifes. Below is a brief overview of the dower and curtesy rules under Arkansas law.

Ad Chat 1-on-1 Online with an Attorney about Anything. Arkansas does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

All Major Categories Covered. You will need a certified copy of. Arkansas does not have an inheritance tax.

How do you transfer a car title when someone dies in Arkansas. However if you are inheriting property from another state that state may have an estate tax that applies. Arkansas does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who.

Although Arkansas has neither inheritance nor estate taxes on the state level the Federal Taxation is relevant for residents and properties located all over the United States. Decedent survived by spouse and one or more childrenthe spouse is endowed with.

The Arkansas Lawyer Spring 2009 By Arkansas Bar Association Issuu

Tax Deed Properties In Arkansas The Hardin Law Firm Plc

Personal Asset Trust Quraishi Law Firm Wealth Management

Transfer On Death Deed Arkansas Us Legal Forms

Power Of Portability This Estate Tax Tool Can Save You Millions Agweb

How To Handle Probate Disputes Bond Law Office

Key Differences Estate Tax Vs Inheritance Tax

When A Gift May Not Be A Gift Miller Butler Schneider Pawlik And Rozzell Northwest Arkansas Attorneys

Power Of Portability This Estate Tax Tool Can Save You Millions Agweb

Transfer On Death Deed Arkansas Us Legal Forms

Advanced Estate Planning Consider Early Gifting The Arkansas Financial Group Inc

How Often Should You Update Your Will Estate Planners Of Arkansas

Transfer On Death Deed Arkansas Us Legal Forms